Cocoa prices rose to unprecedented levels in October, while the demand appears to remain steady despite costs increasing throughout the year. With futures going over USD 3,870 per ton, these are the highest values in 45 years. In addition, we are likely heading toward a global deficit next year, due to lower production in the ley markets of Ivory Coast or Ghana (the world’s first producers), Trading Economics reports, quoting Ivory Coast government data showing that local farmers shipped 17.3% less cocoa in October this year, compared to the same month of 2022. Production has been impacted by heavy rains.

Cocoa price volatility impacted the price of chocolate, which uses it as the main ingredient. Chocolate prices have risen faster than the average rate of food inflation in Belgium over the past year, The Brussels Times reports, leading to a decrease in the consumption of a beloved product in the country. The publication highlights studies showing that chocolate prices in October this year were 11.5% higher than in the same month of 2022. Belgium’s current annual food inflation rate is 8.98%.

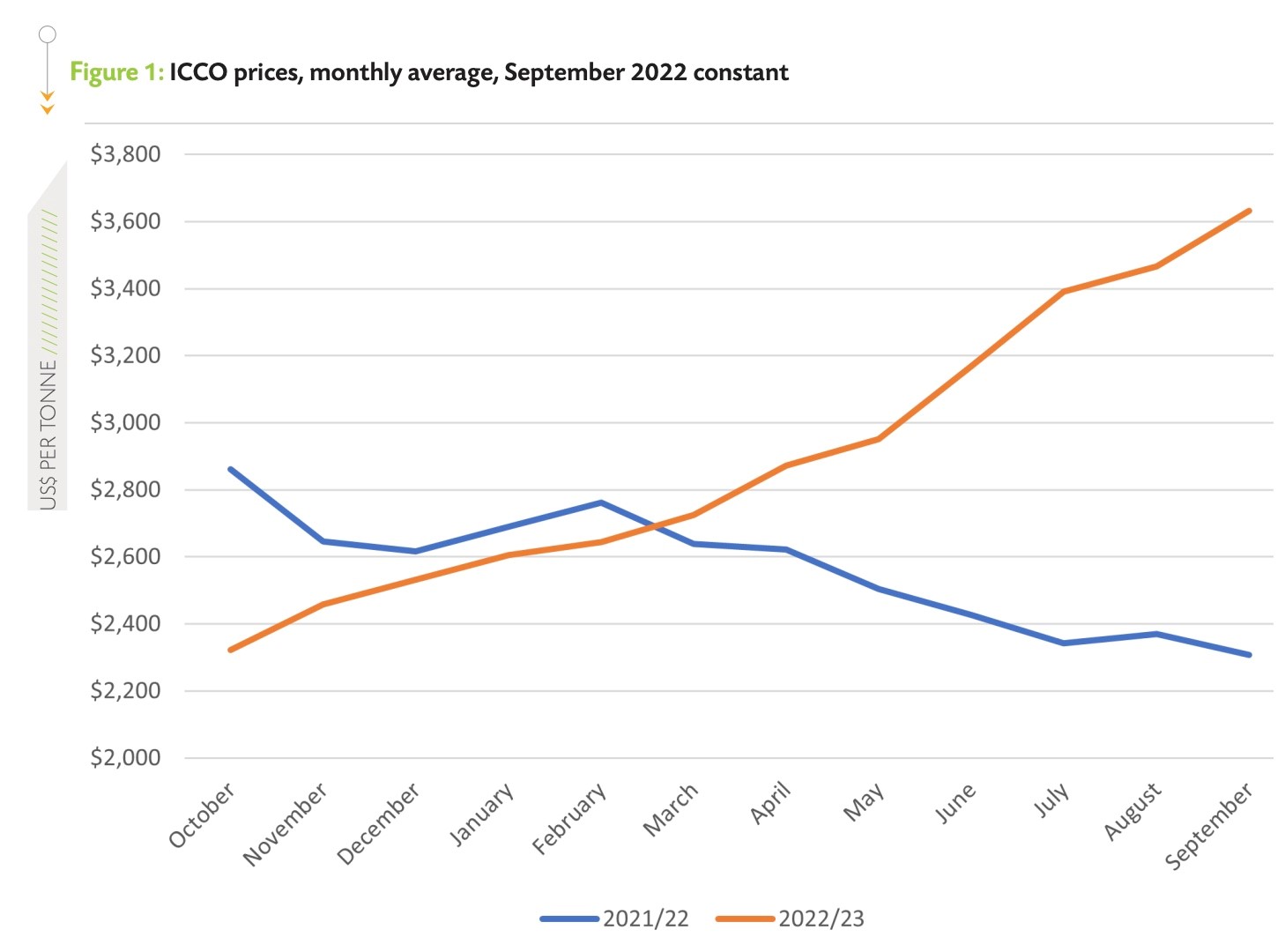

The International Cocoa Organization (ICCO) reports that the global 2022/23 cocoa production increased +2.4% y/y to 4.938 MMT, and global cocoa grindings increased +0.2% y/y to 5.005 MMT. ICCO estimates end-of-season 2022/23 global cocoa stocks at 1.707 MMT and the cocoa stocks-to-grinding ratio at a 7-year low of 34.5%, in the market report issued in September. ICCO projected a global cocoa deficit for 2022/23 of -146,000 tons and said, “The expectation of a supply deficit has been compounded with weather variations, especially in West Africa.”

“A deficit of around 100,000 tonnes is currently estimated for the 2022/23 season which just ended. At this point last year, market participants had predicted a balanced situation for the season. But adverse weather conditions in Côte d’Ivoire and Ghana soon led to a change in these expectations.

Furthermore, hoarding of cocoa beans was observed in Côte d’Ivoire and Ghana during the latter part of the 2022/23 mid-crop. This was fueled by expectations of a higher farm gate price for the 2023/24 season. The incidence of bean hoarding is reported to be one of the disruptions that led Ghana to open the 2023/24 season earlier on September 8, 2023, instead of the start of October 2023. If farmers hoarded cocoa, does this really reflect that the volume of production for the just ended 2022/23 may be higher than actual arrivals and purchases for the season? As part of the 2022/23 crop will be tallied as inclusive of the 2023/24 harvest, the estimated deficit of 100,000 tonnes could be over-estimated. However, it is too early to assess the 2023/24 crop development,” the report details.

Photo: Pexels (#50707)