The economic state of German artisan bakeries

The study is based on the financial accounts for 2018 of 103 of the larger bakeries which may be styled as artisan although the line between the latter and industrial production is blurred. Based on the financial statements for 2018, the latest year for which data is available, it provides a detailed overview of the economic state of the business as a function of the size of the operations. Prior year figures are stated for the sake of comparison.

In cases where financial and calendar years are different the accounts with the balance sheet date in 2018 were used as a basis for calculation.

The advantages of using filed audited accounts are obvious. However, this method also entails the drawback that the sample does not include companies not obliged to publish financial information (e.g., partnerships in the form of the Kommanditgesellschaft, a limited partnership, or the GmbH & Co. KG, a partnership whose liability is normally limited by a limited managment company, but which does not have to disclose financial information if it also includes at least one individual as a non-limited partner). Also excluded in the sample for lack of detailed information are very small companies which need to provide only a balance sheet without providing a profit and loss account. This limitation is notable because about 80 percent of all baking companies achieve turnovers of less than a million euros and 50 percent of these remain below the 250,000-euro mark. For these reasons, the study is not representative in the strict statistical sense of the word. Nevertheless, the size of the sample, which extends through all group sizes, is a suitable basis for the analysis, especially in conjunction with the KPI instrument used for this purpose. It thus provides ample information to ensure a fitting description of the market situation as it was at the turn of 2018.

It should also be taken into account that it was not possible to transfer data automatically from the Register. Hence, the manual entry of some 5,000 data sets is naturally prone to error. However, the control procedures implemented ensure an error margin of less than one percent so that the generalized statements are not limited in any way by errors that may have occurred. This being said, we do not assume any responsibility for individual errors or for the consequences of decisions taken on their basis.

Author

Prof. Dr. James Bruton is a professor of management specializing in business ethics at the University of Flensburg and at the Nordaka-

demie Graduate School, Hamburg, Germany. He is also a qualified tax advisor and certified consultant of the Federal German Initiative “New Quality of Work” (Neue Qualität der Arbeit, www.inqu.de). His latest book in German is entitled “Corporate Social Responsibility und wirtschaftliches Handeln. Konzepte, Maßnahmen, Kommunikation” (Corporate Social Responsibility and Economic Behaviour. Concepts, Instruments, Communication).

The bakery market in 2018

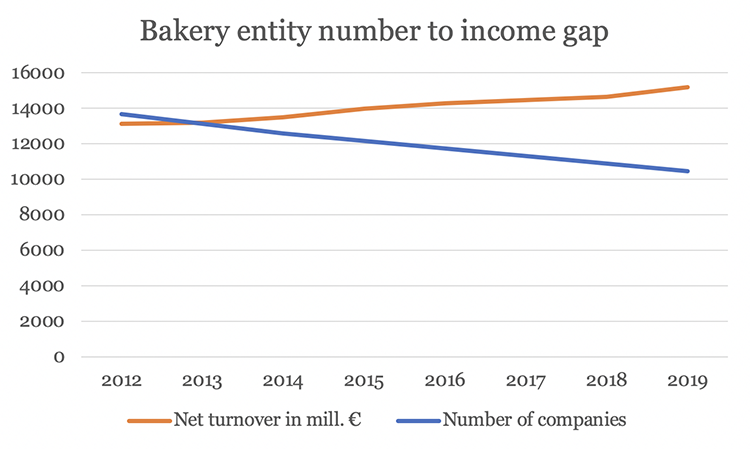

For several years the baking market has been in a regular state of consolidation, a process which began when grocery retailers started to offer bakery products and snacks, and to provide catering areas and restaurant services for their customers to the disadvantage and even detriment of fully fledged bakeries. Consolidation thus implies a drop in the number of companies, with those who nevertheless prevail trying to remedy the situation by rendering their operations more effective and efficient and by reducing their staffing to save costs. It also resulted in the need for them to grow their enterprises, so that we now see a clear trend towards larger companies with a greater number of bakery stores. This goes to explain why turnover levels are continually on the increase and why there is a growing gap between the number of enterprises and the level of turnover. This is illustrated in the following figure for the period from 2012 to 2019.

Brief overview

In the case of medium-sized artisan bakeries we currently see the paradox situation where company numbers are decreasing with less people employed as a result, while at the same time companies managing to stand their ground in the face of mounting pressure in the grocery retail trade, stemming above all from discount stores, have managed to achieve increasing turnover. And there is a growing gap between the two. So as to gain a more thorough understanding of this phenomenon and the current economic state of the baking industry we used a system of key performance indicators based on the latest financial data of 103 of the larger artisan bakeries to analyze and interpret their achievements. This detailed study highlights some rather interesting facts about the business.

Number of bakeries and net turnover for the years 2012-2019

In the six-year period from 2012 to 2018 alone, the number of companies decreased by 20.1 percent from 13,666 to 10,925. The number of employees dropped by 6.8 percent. In the same period net turnover was up by 11.6 percent. This is due to the fact that potential turnover was leveraged in the concentration process by the increasing number of stores taken over from other companies giving up – either owing to becoming insolvent or not being able to find new owners to sell the business to. In this process they avail of synergy and cost degression effects and so big bakeries have grown bigger and better.

The gap between the number of companies and the overall turnover is a general finding and should not conceal the fact that the smallest group of companies, which amount to 5.2 percent of all German bakeries and which achieve individual annual amounts of turnover in excess of 5 million euros, constitute 68.1 percent of the total turnover in the business. 32.6 percent of the companies whose annual turnover lay in the range of between 500,000 and 5 million euros made up a further 24.7 percent of the total turnover, while bakeries with less than 500,000 euros in turnover (tantamount to 62.2 percent of all baking companies in Germany)

accounted for 7.3 percent of overall branch turnover. The latter segment is almost entirely missing in the study owing to financial data not being available.

Another trend is the continual decrease in the amount of bread consumed annually in Germany, which goes hand in hand with the increase in food consumption outside the home, including snacks in-between, and is also paralleled by the increase in one aspect which is two-person households. Another aspect furthering the trend is that people nowadays place far more emphasis on proper nutrition than they did in the past. Company status reports mention a quantitative decrease in bread consumption of 1.8 percent over the previous year. However, this generalized statement needs to be looked at in more detail. According to the research data of Gesellschaft für Konsumforschung (GfK), Nuremburg (GfK Consumer Index 12, 2018), the quantitative decrease amounted to just short of 4 percent, while average sales prices went up by one percent. Alternatively, the sale of bread for toasting increased by 4 percent in terms of quantity and by a little more than 3 percent in terms of prices. Both aspects add up to an overall increase in value of nearly 8 percent compared to 2017. In December, 2018 we see an even broader spread between different types of bread: baguettes/white bread and Mediterranean varieties displayed quantitative increases of 6 and 13 percent, respectively, when compared to the amounts for the previous month. At the same time, the amounts of “normal” types of bread sold were down by 8 percent.

The information given in company status reports indicates that bakeries try to prosper by enhancing their competency through trading up in gastronomy and catering, and out-of-home consumption in general, with a clear shift to operating quick service restaurants. This finding coincides with the insights gained from another important study (cf. Vorderwülbecke, A., Korflür, I. und R. Löckener: Branchenanalyse Brot- und Backwaren-Industrie. Branchentrends und ihre Auswirkungen auf Beschäftigung und Arbeitsbedingungen. Düsseldorf, 2018, Study No. 378 of Hans-Böckler-Stiftung). One gets the impression that a profuse offering of freshly prepared snacks, breakfasts, midday meals, and other dishes is increasingly becoming the normal thing expected by customers. What used to be simple bakery stores are thus becoming enhanced by having standing cafés, many also with seating accommodation. The proprietors seek to create a pleasant atmosphere in an effort to win new customers and retain their old ones. Traditional bakeries are thus beginning to reset their sights on the competitive advantage to be gained through artisan products, focussing on quality, local sourcing, a wide range of products, tradition as a value in itself, and the pleasurable enjoyment of the same. The shift from eating at home to eating outside is seen as a real business opportunity that many bakeries are endeavoring to take advantage of through customer retention programs via a pleasant café atmosphere reinforced by a friendly, service-oriented sales team. Customer orientation, employee motivation, and operational improvements are thus key and success is and will be determined by the speed at which the corresponding internal structures are established.

The aforesaid measures are supported by the Food & Health 2018 study carried out by YouGov, an international data and analytics group. Their study shows that fresh and regionally produced foods are more important to Germans than anything else. They make sure that the products they buy are at least produced in Germany (68 percent of those interviewed) and are ideally from the region they live in (56 percent) because they then expect to get better quality, better taste and overall healthier food. Apart from that, it gives them a “feel good” experience because they see it as an opportunity for them to do something for local businesses and to contribute towards the betterment of the environment. This also goes to explain why many bakers, as they often describe in their status reports, focus on natural raw materials obtained from local producers’ associations which guarantee certain product features throughout the supply chain, such as unsprayed crops. In the same context, the Federation of German Food and Drink Industries refers to “emotional competition” in an effort to win customer trust. This new approach seems to be gradually replacing the old idea of competition based more or less entirely on quality and price (cf. www.bve-online.de/themen/verbraucher).

Companies included in the study

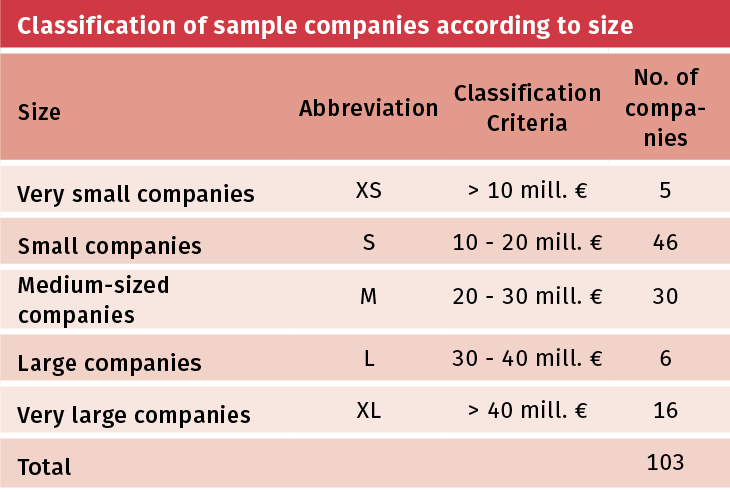

For the sake of a better comparison, the 103 companies included in the sample were classified in five size categories. The net profit margin – and not turnover – was used as grouping criterion, the reason for this being that, depending on size, many companies are exempted from stating their net turnover by the prevailing accounting rules. In such cases, the first line of the profit and loss statements is the net profit margin, which is the balance of turnover and cost of sales. The following table shows the five classes, the classification criteria, and the number of companies in the class.

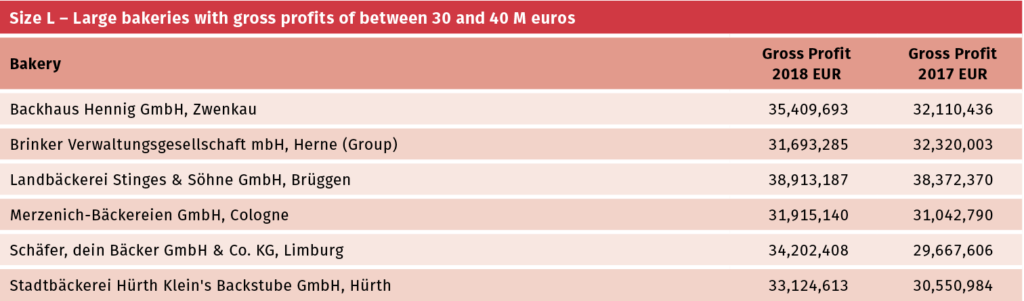

The companies included in the study are listed in the following, classified as above and indicating the gross profit margins for 2018 and 2017, respectively.

Results of the study

The overall earning capacity of the sample companies has improved somewhat compared to the previous year. This finding is on a par with the general trend towards higher turnover as also reported in branch statistics. Improved earning power also means improved financial stability. The cashflow ratio shows an overall decrease with the exception of the very small companies. Equity is generally high and has improved compared to 2017, but has decreased by 2-3 percent in the M and S groups. The equity margin varies widely within the sample and loan repayment periods need also to be taken into account when interpreting this performance indicator.

The efficiency of asset use has generally improved in 2018, above all in the case of the groups S and M. The propensity to invest has decreased, which might be explained by higher levels of investment in the preceding years in order to counteract the pressures posed by the food retail trade and to improve competitive advantage. Ageing fixed assets is an everlasting topic for many companies. Small companies need to keep an eye on this issue to avoid falling back behind the competition.

The analysis of working capital has indicated that many companies have not enough free cash available to finance necessary investments and therefore need to rely on external financing sources. The reports show that companies resort not only to banks and associated companies but also take advantage of modern strategies such as the emission of corporate bonds or use some form of investment franchising. Personnel intensity levels reach 57 percent of gross profit on average, which is rather high in comparison to other branches. Only companies with gross profit margins beyond the 30-million-euro mark seem to achieve a lower percentage. Again, this depends on their business models, for example, industrial production mode, and franchising models. Even some smaller companies in the S and M groups are more industrialized than artisan businesses and employ less people as a result.

All in all, it can be said that the concentration process outlined above is still in full swing. This results in companies still having to further readapt to the prevailing market conditions. It looks as though the gross majority of the companies in the sample have come a long way in improving their situation by refocusing their business strategies and by working towards more efficient and effective operations. Based on the information that can be derived from the key performance indicators for 2018, they seem to have risen from the food retail crisis like the proverbial phoenix from the ashes.