Lotus Bakeries’ sales amounted to EUR 657.3 million in the first half of 2025, a year-on-year increase of almost 10%. The organic sales growth is driven by double-digit volume increases of Lotus® Biscoff® and Lotus™ Natural Foods. The US sales of Biscoff® and BEAR® combined grew by “an outstanding 18%” in the first six months of 2025. Both brands are among the fastest-growing brands in their respective categories.

The Natural Foods business grew by more than 16% and saw double-digit growth across all brands. BEAR, TREK, nākd and Kiddylicious are category-leading brands in the UK, Lotus Bakeries illustrates. TREK® Protein Flapjack with Biscoff® is the #1 innovation in its category this year, the company announced, and TREK is the fastest growing brand in its category in the UK in the first six months of 2025.

The brands are expanding internationally: “The ambitious expectations were exceeded with growth outside of the UK of more than 30% in the first six months of 2025. Since its launch in the US in 2018, BEAR has developed into a leading brand in the Kids Fruit Snacking category with an appealing, distinctive, healthy and affordable proposition. The BEAR fruit snacks are produced in the plant in Wolseley, South Africa. The operation in South Africa is sourcing the raw material fruits locally from the Ceres valley, an internationally well-known, fruit-growing region. The BEAR brand in the US remains an important contributor to the international growth of Lotus Natural Foods. The impact of increased US import tariffs will be mitigated by different actions, leveraging the strength of the brand and with the ambition to remain affordable for the US consumers,” the company highlights.

Lotus® Biscoff® saw a 10% volume increase, with a corresponding revenue growth of over 11%. Lotus Bkeries attributes the performance to a “Well-managed and optimal output of the factories, given the 2025 capacity challenge, i.e. the available capacity for Biscoff®’s original cookies allowing for a volume increase of not more than 10%.”

New co-branded chocolate innovations under the brands of Cadbury®, Milka® and Cote d’Or® were launched in the UK and Europe in recent months. The Cadbury®-Biscoff® or the Milka®-Biscoff® tablets are the number 1 or number 2 selling SKU in the category, Lotus Bakeries reports: “Both Mondelēz and Lotus Bakeries are absolutely delighted with these initial positive results.”

In March, Lotus Bakeries announced that also the Biscoff ice-cream category would be integrated into the licensing agreement with Mondelēz, opening doors to the leading pure play ice-cream manufacturer, Froneri. The partnership between Lotus Bakeries and Froneri will allow the Lotus Biscoff brand to grow faster in the ice-cream segment and with a global footprint. Starting in 2026, Froneri will be producing, marketing and selling Biscoff ice-cream in several European countries.

Lotus® Local Heroes

In the first half of 2025, Lotus® Local Heroes’ revenue is flat. Declining gingerbread sales in the Netherlands were offset by growth in pastry and waffles. The steep increase in cocoa prices forced the introduction of a double-digit price increase for chocolate-covered products, the report shares.

Jan Boone, CEO, comments on the top-line performance of the first half-year: “In view of the significant volume growth we realised in 2024, the year-on-year consecutive volume increase of both Lotus® Biscoff® and Lotus™ Natural Foods is a testament to the strength of the different brands. For Biscoff, we have a solid growth strategy and focus on our hero products Biscoff cookies and Biscoff spread. For Biscoff ice-cream and chocolate with Biscoff, we leverage upon a strong global partnership with Mondelēz that will help us to grow Biscoff awareness globally. For Natural Foods, the innovations continue to drive growth and the business is expanding internationally at a strong pace. A special call-out for the outstanding 18% growth in the US in the first six months of the year. Biscoff and BEAR are both strong contributors and both rank among the fastest growing brands in their categories.”

Investments

The company invested over EUR 135 million over the past 12 months.

- Greenfield Biscoff® plant in Thailand

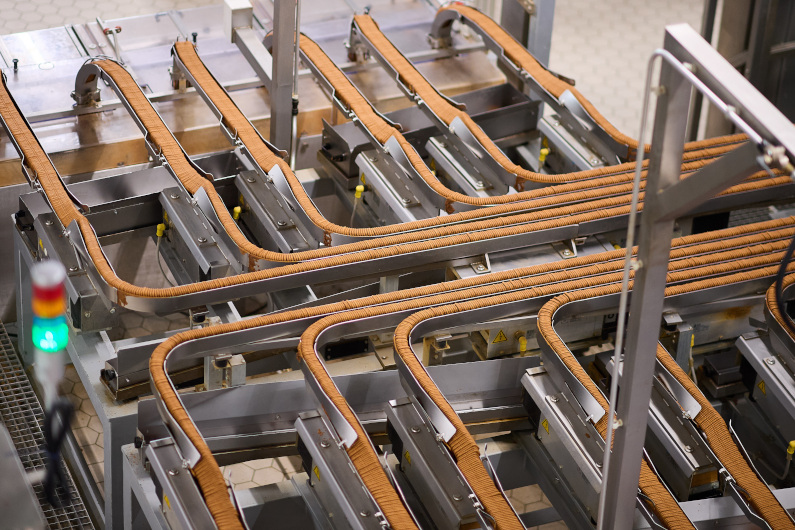

Lotus Bakeries is currently investing in Thailand (Chonburi) in a new greenfield production facility for Lotus® Biscoff® to further support its growth ambition in the Asia-Pacific region.

The plant and project teams have made significant progress in the past months to the extent that Biscoff® cookies will be produced and shipped to consumers in the second half of 2025. The test runs confirm that the cookie produced on the line in Chonburi is on par with the quality and taste of the other Biscoff factories, the company announced. In recent months, a large group of Thai employees was hosted and trained in the plant in Lembeke.

The plant is anticipated to be completed and fully operational by May of 2026.

- Biscoff® spread jar

The jar’s design is inspired by the shape of the original Biscoff cookie and emphasises that the spread is made by carefully milling real Biscoff cookies to create a delightful taste and texture.”

- Locally-made Biscoff® spread

Besides the new spread jar, Lotus invested in spread production and bottling and recently commissioned the plant in Mebane (US). “On top of the financial and ecological benefits of this localised production, it also eliminates the impact of increased import tariffs in the US. The US will also be the first production site and country where the new jar will be launched ahead of a global rollout by the end of 2026.”

The plant in Thailand will also be equipped with spread production and in-house bottling of spread jars.

Outlook

The current weak USD exchange rate could hurt consolidated sales in the second half of the year by up to 1.5%, Lotus anticipates.

With the start-up of the plant in Thailand advancing ahead of schedule, the company is about to reach a new milestone in the second half of 2025. Although the volume impact in 2025 will still be limited, the step-up in capacity provides a solid foundation for ambitious 2026 commercial plans.

The spread investments in both US and Thailand are aligned with the footprint strategy to have the production capabilities for the full range of Biscoff’s hero products in all three Biscoff sites producing for Europe & the Middle East (Lembeke), the Americas (Mebane) and Asia-Pacific (Chonburi).

The capital expenditures for the years 2025 and 2026 combined will be at least EUR 250 million. For Biscoff, the program entails future capacity expansions on the three continents.

Photos: Lotus Bakeries