By Tom Rees, Industry Manager – Food & Nutrition, Euromonitor International

After putting consumer resilience and adaptability to a test in 2021, access and action are driving worldwide trends this year. Euromonitor International analyzes market sizes, with historical and forecast data, and finds consumers favor their cakes: this product segment is set to record the biggest year-on-year growth – 5% between 2021 and 2022.

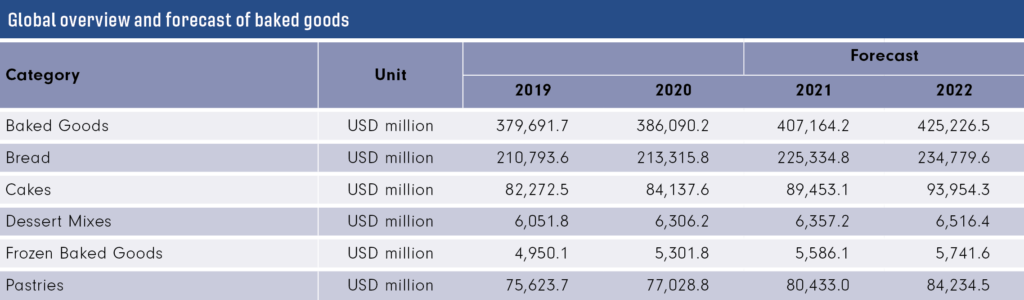

The global market of baked goods has navigated two years of profound disruptions, from which it has emerged with newfound strength: Euromonitor International estimates a 5.5% year-on-year (YOY) growth for the 2020-2021 period, followed by a 4.4% YOY forecast for 2021-2022. For comparison, the pre-pandemic baked goods market grew by 1.7% (2019-2020).

All health and immunity concerns considered, the research company estimates cakes recorded the biggest increase, with an estimated 6.3% YOY growth last year, followed by a 5% uptick this year, according to forecast data. The bread product segment enjoyed a similar growth last year, with a 5.6% expansion, which is expected to settle into a 4.2% growth value this year. Frozen baked goods were among the favorite categories during various levels of lockdowns, after an initial decline (from 7.1% in 2019-2020 to 5.4% last year). Euromonitor estimates this segment grew by 5.4% in 2020-2021. As restrictions are lifted, frozen goods are expected to slow down to half of this level, to a 2.8% YOY growth.

Pastries are a promising category for consumers and manufacturers, with strong growth: 4.4% YOY growth last year, and an estimated 4.7% growth worldwide, up from 1.9% YOY growth pre-pandemic. Dessert mixes are rebounding, after a sharp drop in 2020-2021: the YOY evolution in the past four years is estimated to go from 1.9% to 4.4% and reach 4.7% this year, Euromonitor data shows.

By market share, the world’s top five players are Grupo Bimbo SAB de CV, Yamazaki Baking Co Ltd., Flowers Foods Inc, Shikishima Baking Co Ltd. and Fuji Baking Co Ltd.

Taking back control

Every year, Euromonitor International identifies emerging and fast-moving trends that are expected to gain traction in the year ahead. These trends provide insight into changing consumer values, exploring how consumer behavior is shifting and causing disruption for businesses globally. Access and action are the driving forces behind the top 10 global consumer trends in 2022. Resilience and adaptability were tested in 2021, forcing consumers to relinquish control and embrace ambiguity. This year, consumers are taking back the reins and paving a path forward based on their passions and values.

The top 10 global consumer trends identified for 2022 are Backup Planners, Climate Changers, Digital Seniors, Financial Aficionados, The Great Life Refresh, The Metaverse Movement, Pursuit of Preloved, Rural Urbanites, Self-love Seekers, and The Socialisation Paradox.

Top 10 Global Consumer Trends

- Backup Planners: Consumers find creative solutions to purchase their go-to products or search for the next best options as supply chain disruptions cause massive shortages.

- The Socialization Paradox: Fluctuating comfort levels create a conflicting return to pre-pandemic life. In 2021, 76% of global consumers took health and safety precautions when leaving home.

- Climate Changers: Eco-anxiety and the climate emergency drive environmental activism for a net-zero economy. In 2021, 35% of global consumers actively reduced their carbon emissions.

- Digital Seniors: Older consumers become savvier tech users. Virtual solutions must be tailored to the needs of this expanded online audience.

- Financial Aficionados: Democratized money management empowers consumers to strengthen financial literacy and security. More than half of global consumers believe they will be better off financially in the next five years.

- The Great Life Refresh: Consumers focus on personal growth and wellbeing, making drastic life changes that reflect their values, passions and purpose.

- The Metaverse Movement: Immersive, 3D digital ecosystems begin to transform social connections. Global sales of AR/VR headsets grew 56% from 2017 to 2021, reaching $2.6 billion last year.

- Pursuit of Preloved: Secondhand shopping and peer-to-peer marketplaces flourish as consumers seek unique, affordable and sustainable items.

- Rural Urbanites: Consumers relocate to safer, cleaner and greener neighborhoods.

- Self-Love Seekers: Authenticity, acceptance and inclusion are at the forefront of lifestyle choices and spending habits as consumers embrace their truest selves.

Amongst these, Backup Planners will be key for baking and the bakery market. Faced with challenges in securing their usual or desired products and services, Backup Planners are looking for ways to purchase similar items or finding creative solutions to obtain alternatives. While, by late 2022, supply chains should start to stabilize and access to products should revert to pre-COVID-19 levels, the new shopping habits consumers have acquired will dictate how Backup Planners discover and select products. Goods that emphasize local sourcing and offer direct-to-

consumer/subscription options will hold appeal here.

Another global consumer trend of particular relevance will be the Self-love Seekers. For these consumers, acceptance, self-care and inclusion are at the forefront of lifestyles. Self-love Seekers prioritize their happiness, feeling comfortable in their own skin and indulging in goods and services that elevate their sense of self. In food, and in bakery, in particular, these consumers are not necessarily looking for standard-issue ‘permissible indulgence’ (e.g. claims that seek to assuage guilt over sugar, fat, calorie intake etc.), but rather tastes that align with their ideas of who they are and fit with self-acceptance – allowing them to simply be happy before, during and (crucially) after eating.

Finally, the global consumer trend of The Socialization Paradox will be important, as it tracks how consumers are approaching a return to pre-pandemic life in different ways based on their comfort levels. Certain consumers are eager, whilst others are hesitant, to resume their normal activities. This opens up opportunities for gifting, allowing bakery products to be the social lubricant for the hesitant and the keen alike. For those consumers reluctant to fully socialize once more, home baking will continue to benefit as an activity that can not only be enjoyed solo, but also as a social-but-not-in-person activity through online group participation.

“Businesses need to transform alongside rapidly evolving consumer preferences,” says Alison Angus, head of lifestyles at Euromonitor International. “Reverting to a pre-pandemic playbook is not likely to generate the same results moving forward.”